Running a restaurant here in CA, especially here in the Bay Area, can be challenging enough for the restaurant owner to plan and execute. Along with running the daily operation of your business, the topic of insurance can be overwhelming. However, with hundreds of data points coming from everywhere, it’s foolish not to take advantage […]

CEA: Earthquake Insurance Purchases Up Sharply in CA

Check this out: Just wanted to take a moment to chat about the CEA California Earthquake Authority program. Earthquake insurance purchases have been up sharply. The CEA has sold 9,000 earthquake policies in January of 2018. That’s more than the average number of policies sold for an entire year from 2005 to 2015 and is […]

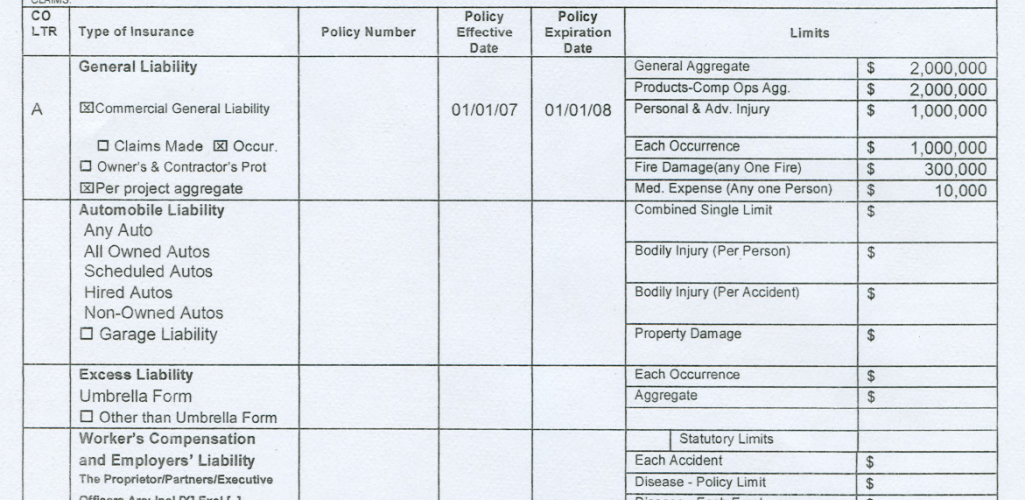

What is a Certificate of Insurance?

A certificate of insurance is a document that proves you have the necessary insurance coverage as mandated by an organization, employer, vendor, or other stakeholders that have an interest in your ability to respond in case of a covered peril. In our personal lives, for instance, those of us who drive a car carry a […]

What type of insurance do I need to start my new business in CA?

If you are starting your own business in California, you are probably inundated with legalities, obtaining permits, licenses, and tying up all the various loose ends that you need to tend to before you open your doors. In addition, you might be wondering what type of insurance you are going to need to protect you, […]

Workers Compensation Insurance in CA

Workers compensation in California is a highly detailed and nuanced subject. As the regulations are very state-specific, it is important to understand what your obligations are in the state of California and how you can ensure compliance. As it would be impossible to explain every letter of the law in one post, we’ll look at […]

If I get into an accident and make a claim, will my rates go up?

In the unfortunate circumstance that you get into an automobile accident, having insurance can be a godsend. Depending on the coverage you have, you may able to get your car fixed and have all damages paid without being out of pocket over and above your deductible. However, many people worry about what happens when they […]

Insider Tip: Actual Cash Value vs. Replacement Cost Insurance

Do you remember this moment in your own life? Daniel had just gotten his first paycheck. He had kept track of the hours he’d worked and calculated exactly how much he’d earned in his first pay period. (And made plans on what to buy with the money!) But when he ripped open the envelope, he […]

If I rent a car in CA, do I need to take out the rental agency’s coverage?

One of the most frequently asked questions we get is about whether our insurance customers need to purchase extra coverage when they rent a vehicle either at home or on vacation. It would seem that most car rental agencies try very hard to intimidate their renters into purchasing their additional coverage – it’s […]

Should retirees utilize their retirement monies for investing in real estate?

I receive a lot of questions about this topic. Most of us put our savings to purchase real estate. There are a few using IRAs. This is also called Self Directed IRA. Most IRA investors use their retirement plans for stocks, bonds and mutual funds. However, very savvy investors choose the Self-directed IRAs. These investors […]

CEA: Earthquake Insurance Purchases up Sharply in CA

The California Earthquake Authority sold 9,000 earthquake policies in January of 2018. That’s more than the average number of policies sold for an entire year from 2005 – 2015 and on track to exceed last year’s record 90,707. What’s causing this big increase? And does buying earthquake insurance make sense for you? Living […]