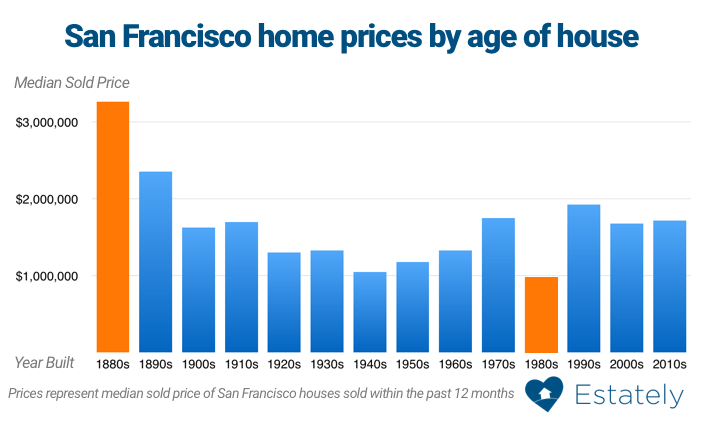

For many individuals, inheriting property is usually seen as a good thing. After all, with home prices rising after the 2008-2009 housing crisis, homes are once again considered a good investment. By Q4 2017, the median sales price for homes in the US was over $330,000, an $80,000 rise from the 2007 height just before the crash and an all-time high in the US housing market. These median prices do not reflect a market-by-market reality, however. In the San Francisco Bay Area, for example, median home prices are higher than ever, at over $800,000.

Inherited homes come with liability risks

Inheriting a home or other any other type of property can come with a significant liability risk. In some markets, including San Francisco, many available homes and properties are old builds often dating back to the WWII era or earlier. For San Francisco, in particular, the majority of the homes on the market were built before the 1950s, with many dating back to the 1920s. Those homes also tend to have the highest values.

Even if those homes were updated over the years with additions to polish their look externally, they may not have had the proper facelift they need internally. Significant electrical, plumbing or heating/cooling issues could be hiding the walls, while roofing problems could exist that are not visible without closer inspection both inside and outside of the house.

It’s easy to assume that the inherited homeowners or property insurance policy will cover most of those needs. What many individuals inheriting or even purchasing properties such as homes or apartment complexes may not realize is that there could be a gap in insurance coverage. In fact, homeowners insurance policies often lapse after the previous owner passes away and the property is inherited by another party.

Additionally, if the homeowners policy has not been updated in years, it may not have enough coverage for the total value of the existing property. Considering the run-up in home prices in the San Francisco Bay Area, a gap in coverage is far more likely than in many other markets. And in cases where the insurance lapses and a new policy needs to be written, the new insurance provider may have pre-existing condition exclusions that don’t cover old wiring, mold damage from old and broken piping or leaking HVAC systems, or damaged roofs.

Property investors and those inheriting properties, especially old builds, should be proactive in investigating some common issues that create liability risks where insurance coverage often doesn’t exist. Many of the issues that exist in inherited homes may need to be updated or fixed before a property or homeowners insurance company will consider extended standard coverage.

The problem with aging electrical systems

Electrical systems are a necessity in modern homes, but they’re also one of the most dangerous fixtures. According to the National Fire Protection Agency (NFPA), between 2010 and 2014, there were over 45,000 home fires caused by electrical failures. Of those, more than half (57%) were because of “Electrical distribution, lighting, and power”. Overall, electrical fires were responsible for over 400 deaths, over 1,300 injuries, and more than $1.4 billion in property damages.

Knob and tube, fuse boxes, and old wiring

As for insurance coverage, fires are a commonly covered area for most policies. But many insurance policies may not cover fires that are a direct result of faulty wiring or electrical systems. In fact, when you inherit or purchase an older property built before the 1940s, insurance companies may choose not to cover the property at all if it still has knob and tube wiring installed.

According to the National Association for Certified Home Inspectors (NACHI), knob and tube wiring is not inherently dangerous or a fire hazard. However, this type of wiring does not stand up well to the test of time, making its installation in older homes problematic. Additionally, if the wiring was improperly installed or modified over the decades since its placement, it may have other issues that could cause a hazard.

Knob and tube wiring does not support 3-pronged outlets, so if the property has a fair number of two-pronged outlets and is an old build, there may be knob and tube wiring in place.

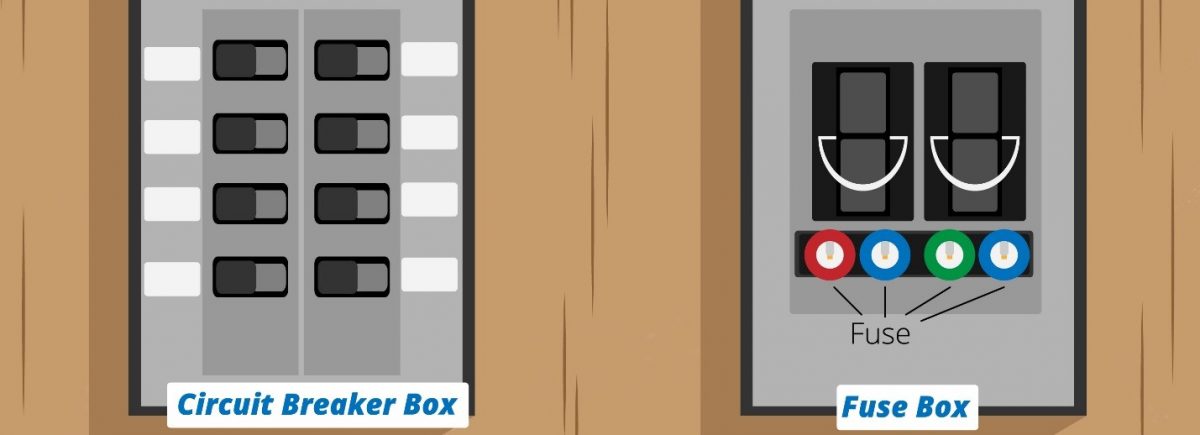

In a similar vein, many older homes in the San Francisco Bay Area have heavily outdated fuse boxes. Current electrical safety standards support the use of circuit breakers over fuse boxes, primarily because fuse boxes are ill-equipped to handle the type of energy demands placed on them with today’s much heavier demand. Not only are blown fuses inefficient since they must be replaced each time, but they are also a potential fire hazard. As with knob and tube wiring, most insurance providers will likely deny coverage until fuse boxes are replaced with circuit breakers.

When inheriting a property, it’s important to get the wiring and electrical system inspected upon acquiring the home, as other, unknown wiring issues could exist even in newer builds. Once these issues are covered, an insurance company will more likely consider offering coverage to mitigate normal risks.

Old plumbing poses health and property damage risks

Plumbing is often one of the more problematic fixtures in a home. Some of the issues associated with old plumbing are easy to spot. For example, water leaking from a pipe under a sink is a clear indication of an issue.

However, most plumbing in a home is intentionally hidden from view. Even if there is no leak from visible pipes, there may be a leak elsewhere from pipes running through the walls, under the floors, in crawl spaces, or under the ground. Consistent leaks can result in dangerous forms of mold which may be impossible to see without tearing out walls and floors.

Some insurance may cover the cost of mold inspection and remediation from “covered perils”, such as floods. But most insurance policies, including property insurance, won’t cover the costs if the mold was the result of a preventable issue, such as leaking pipes.

Old pipes can also pose a health risk, especially if they are composed of materials that are now deemed unsafe, such as lead and galvanized zinc. Old pipes may also be prone to breakage due to the materials used.

Lead and polybutylene

Lead piping can be a significant problem. Many homes in the US built before 1950 were built with lead piping. Although much of that piping was likely replaced at some point after the true dangers of lead in water were discovered, there’s a chance some older properties still have lead piping in them. Lead can also get in contact with water in pipes if the soldering used to connect pipes together had a significant amount of lead in it. And up until 2014, faucets and valves were still allowed to be composed of 8 percent lead.

Also of concern is whether or not a home has polybutylene piping. Polybutylene is a form of plastic that was popularly used in water piping. However, regular exposure to chemicals in the water, such as chlorine, can cause the pipes to become brittle and eventually break. After years of complaints and lawsuits, the manufacturer was forced to pay out nearly $1 billion in a class action lawsuit. However, that money is gone, and anyone inheriting or purchasing a property with polybutylene will need to take on the cost of replacing the entire system.

Galvanized vs. copper piping

Many homes in the San Francisco Bay Area and other parts of the country were built with galvanized metal piping. Typically, zinc was used to galvanize the metal and create a coating over inside surface of the pipes. However, over time, the zinc can corrode, leaving the pipes prone to rusting away. Leaks are common with old, galvanized pipes, but health hazards can also exist as rust and other contaminants get into the water due to the corrosion.

The current alternative for metal piping is copper. Copper is resistant to the kind of corrosion that galvanized piping experiences, even over time. However, copper is expensive, meaning those who inherit or purchase properties where metal piping is preferred will need to consider the costs involved in replacing old, galvanized piping with copper piping. As with many other issues with older homes, insurance may not cover the replacement, and in the case of a lapse or gap in insurance, providers may not extend coverage until the problematic piping is replaced.

Problems with HVAC, ventilation, and roofing

Keeping a property well ventilated and free from the influence of the outside elements is essential. Older homes quite often have an issue with draftiness, but there may also be issues with their HVAC systems, ventilation, and even roofing.

Roofing problems and lifespans

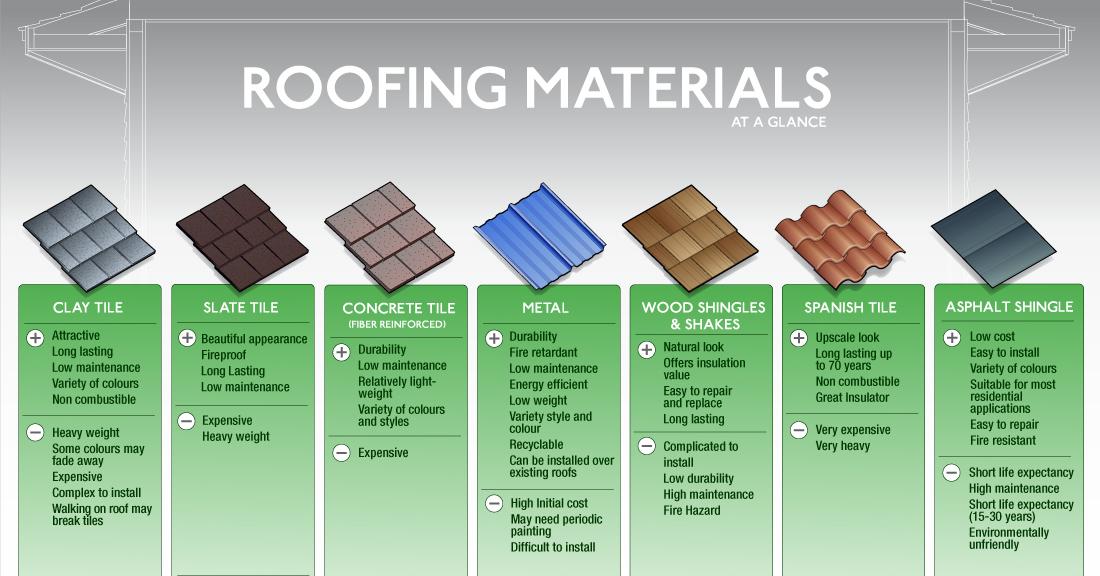

All roofing materials have a lifespan, with some shorter than others. Additionally, some roofing materials may be more or less prone to damage.

Inherited or purchased properties in the San Francisco Bay Area may have roofs that have outlived their usefulness. In the Bay Area, composition shingles and bitumen materials are common. Composition shingles only have a lifespan of around 20 years, while a modified bitumen roof has an even shorter lifespan of around 10 to 15 years. Once those materials have hit their effective age, they begin to wear and may cause leaks and damage to the wood below them.

There may be visible signs that there’s a problem with a roof from the outside. However, the full extent of roofing issues is hard to assess without a look on the inside of the house through the attic. At times, all that’s needed is a tile replacement. But some properties may have other roofing issues, including holes in the roof made by animals, or damage to the roof from falling debris that was later covered by roofing tiles but not fixed properly.

HVAC and ventilation

HVAC and ventilation go hand-in-hand, and pre-existing issues with either system may not be covered by insurance. Ventilation is important, not just to help ensure the home’s air quality is good, but to help avoid issues such as excess moisture buildup. The HVAC system is designed to help with ventilation, but old HVAC systems may be a fire hazard.

Additionally, old HVAC systems may fail during critical seasons, such as the heat of summer or the cold of winter, leaving residents in precarious positions. For those inheriting or purchasing apartments, especially, inoperative HVAC systems during life-critical temperatures become a significant liability risk.

Do not rely on insurance. Be proactive in risk management

If you’ve inherited a home or plan to purchase an older home in the San Francisco Bay Area, it’s important to contact a professional insurance agency. There are numerous risks to inheriting or purchasing an older home that a professional insurance agency can help you navigate successfully.

Ben and Pam from BLW Insurance Agency, Inc., can help you determine what areas your homeowners insurance will cover, where gaps exist, and what you can do to ensure you get the proper coverage. Give us a call at 650-873-1255 and we’ll be happy to answer any questions and/or concerns you have about your potential liability risks and limitations on your insurance coverage, along with what might the best course of action for you.