A certificate of insurance is a document that proves you have the necessary insurance coverage as mandated by an organization, employer, vendor, or other stakeholders that have an interest in your ability to respond in case of a covered peril.

In our personal lives, for instance, those of us who drive a car carry a certificate of insurance on our person every day. This is the document we must present to a police officer if, for example, we are pulled over for a moving violation. This certificate proves that we have the minimum insurance coverage required by California state law.

Certificate of insurance for small business in CA

Small business owners need a certificate of liability insurance to prove coverage in the event somebody was injured on your property or suffered an injury because of one of your employees. Your certificate provides proof that you have the proper insurance in place should you ever need to provide it.

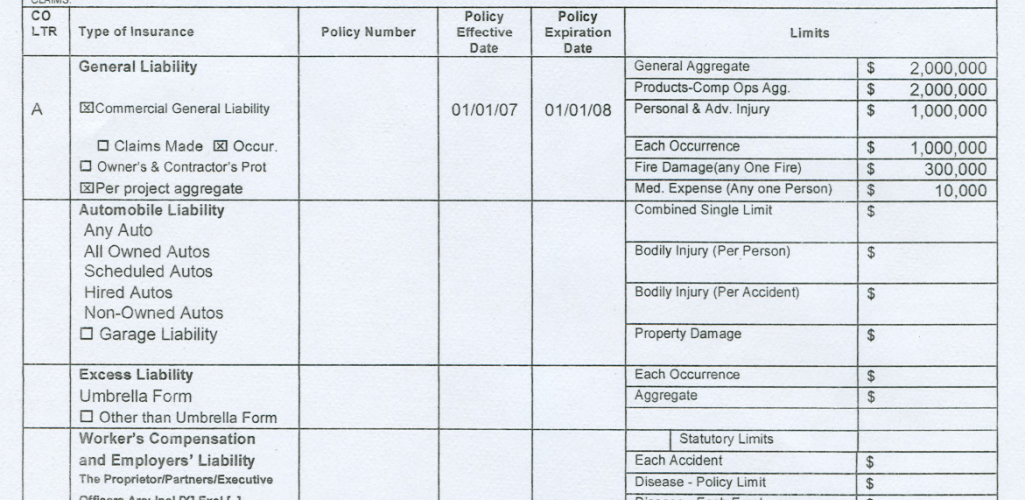

This certificate of insurance would be a one-page official document that provides details of your coverage, whether that is a business owner’s policy, professional liability coverage or general liability. The certificate would contain:

· The name of the insured party/business

· The types of coverage

· The limits of your coverage

· Your policy number

· The issuing company’s name

· The dates your policy is effective

Your insurance certificate is issued along with the policy and should be included in the documents you receive when you purchase insurance.

In some cases, a client may ask to be added to a certificate of liability and this is not an uncommon request. Adding them to the policy does not give them any specific rights under the policy, it simply acknowledges that such a policy exists.

This may come into play if, for instance, you are a film company working with a sub-contractor or production company that is engaged in a project on your behalf; or, if you and another employer share a joint responsibility to pay workers comp to employees who are working together on the same job.

Other types of business policies that may need you to present a certificate of insurance include:

· Workers compensation insurance

· General liability insurance

· Property insurance

· Commercial auto insurance

How fast can I get a certificate of insurance?

If you have lost or misplaced the certificate of insurance from an existing policy, contact your insurer right away to request a re-issue of your insurance certificate.

For new policies, the cert will be issued along with other documents when the policy is activated.

Some things to know about insurance certificates

If you need your insurance certificate issued in your DBA, you will need to request it, especially from your insurance provider. If your business operates under more than one DBA, you may need one for every separately named business entity.

If you need to provide a certificate to several different vendors, you will have to request a separate certificate for each vendor.

Insurance certificates for independent contractors in CA

When contractors work on another company’s or person’s property, they may be required to carry a certificate of insurance. This will protect the contractor from claims as a result of damages they cause to the property or injuries that they incur during the course of doing their work.

Companies that hire contractors often want to be sure that they will not be held liable for any injuries or for work that does not meet their standards. If this is the case, they may ask for a certificate of insurance.

Contractors of all kinds may require independent contractors’ liability insurance as well as other coverages that are specific to the work they do, and the inherent risks involved. Such contractors might include:

· Construction contractors

· House cleaners

· Carpet cleaners

· Hair stylists and aesthetics professionals

· Animal trainers

· Personal trainers

· Tradespeople (plumbers, electricians, painters, etc.)

· Freelance designers, developers, writers

In these cases, having the right insurance coverage can provide protection from injury, damages or lawsuits that arise as a result of the work that was done or while the work was being done. Independent contractors might consider a range of coverages that include liability, business income interruption, commercial auto insurance, professional liability, and property damage.

If you would like to learn more about certificates of insurance, reach out to us today.

What to do next?